Market Overview 2025-2033

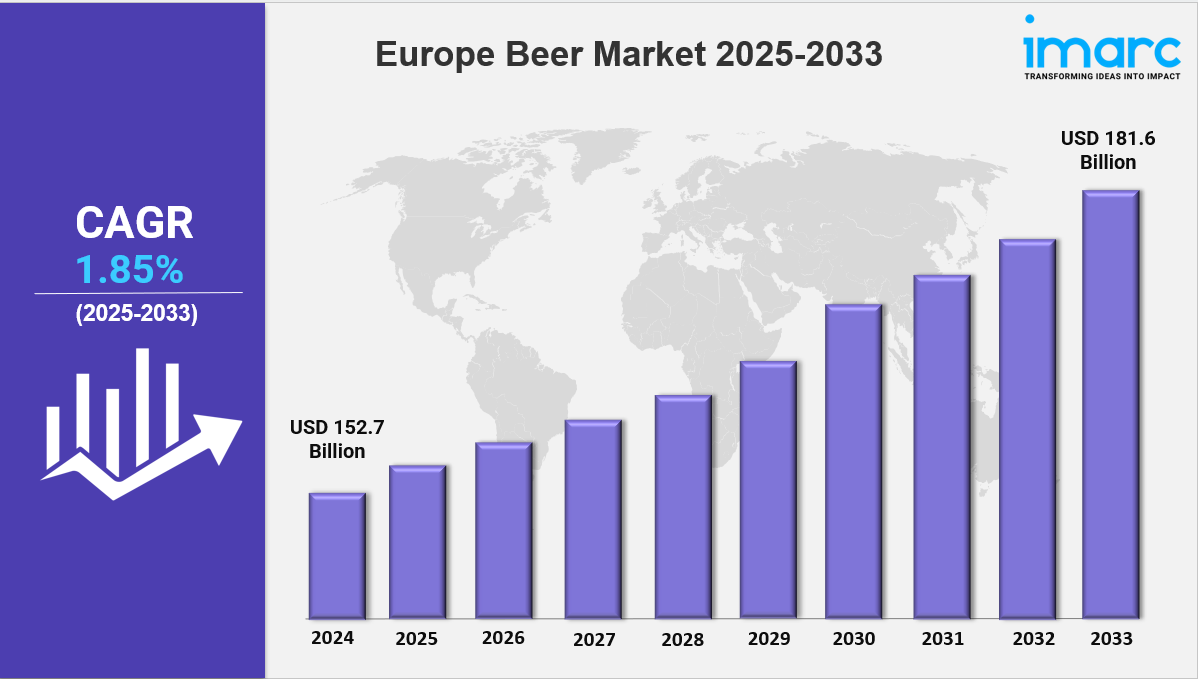

The Europe beer market size was valued at USD 152.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.6 Billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033. The market is expanding due to rising consumer demand, craft beer trends, and premium product innovations. Sustainability initiatives, changing preferences, and technological advancements are driving growth, making it a dynamic and competitive industry.

Key Market Highlights:

✔️ Steady market growth driven by rising demand for craft, premium, and low-alcohol beers

✔️ Increasing consumer preference for sustainable and locally brewed beer options

✔️ Expanding distribution through e-commerce, breweries, and specialty retail stores

Request for a sample copy of the report: https://www.imarcgroup.com/europe-beer-market/requestsample

Europe Beer Market Trends and Drivers:

As customer tastes change, the beer market in Europe is changing dramatically. Low-calorie and non-alcoholic substitutes are becoming more and more popular among health-conscious consumers. Sales of beer without alcohol increased by 18% in Germany, the Netherlands, and Scandinavia in 2024, indicating an increasing trend toward wellness. Brewers are responding by introducing novel products like organic and gluten-free beers and using cutting-edge fermenting methods to maintain genuine flavors.

Simultaneously, premiumization is influencing purchasing behavior. Craft breweries, small-batch brews, and limited-edition releases are gaining popularity, especially among younger consumers. This fusion of health awareness and indulgence is prompting traditional beer brands to diversify their portfolios. Many are blending their heritage with modern dietary trends to appeal to customers who value both quality and health-conscious options.

Nowadays, strategic planning in the European beer industry places a strong emphasis on sustainability. Breweries are being encouraged to implement closed-loop production methods under the EU's Circular Economy Action Plan in an effort to cut waste and carbon emissions. More than 60% of mid-sized breweries in France and Belgium made investments in biodegradable packaging, water recycling, and renewable energy in 2024. The sourcing of raw materials is being transformed by cooperative "green" supply chains for barley and hops, and carbon-neutral certification is emerging as a crucial distinction in the market. Customers that care about the environment, especially Gen Z, are drawn to companies that share their values and are prepared to pay more for sustainable options. Because of this, brand credibility now depends on sustainability reporting being transparent.

Digital transformation is also redefining how beer is sold. Since 2024, e-commerce and hybrid retail models have gained traction, with online sales accounting for 22% of total beer revenue in the UK and Italy. Subscription boxes, virtual tasting experiences, and personalized AI-driven recommendations are reshaping customer engagement. Direct-to-consumer (D2C) platforms allow breweries to bypass traditional retailers, enhance profit margins, and build stronger brand loyalty through data insights. Social media is fueling the rise of niche styles—like hazy IPAs and heritage beer recipes—helping microbreweries scale quickly. However, this shift also demands robust logistics and cybersecurity infrastructure to ensure resilience.

Despite these modern developments, tradition still plays a vital role. Iconic beer styles, such as Bavarian lagers and Czech pilsners, remain deeply rooted in European culture. At the same time, consumer curiosity is driving interest in bold new flavors, like coffee-infused stouts and sour ales aged in wine barrels.

Regulatory changes, including the 2024 EU excise tax reforms, are facilitating cross-border trade while intensifying competition. The craft beer movement remains strong, with more than 12,000 independent breweries operating across Europe. However, increasing acquisitions by larger brewers suggest a trend toward consolidation.

Climate change poses further challenges. In Southern Europe, water scarcity is compelling breweries to adopt more efficient resource management practices. As the market evolves, the ability to blend traditional craftsmanship with innovation, sustainability, and digital engagement will be critical to long-term success. The future of the Europe beer industry hinges on how well brands adapt to this dynamic landscape.

Europe Beer Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Product Type:

Standard Lager

Premium Lager

Specialty Beer

Others

Analysis by Packaging:

Glass

PET Bottle

Metal Can

Others

Analysis by Production:

Macro-Brewery

Micro-Brewery

Others

Analysis by Alcohol Content:

High

Low

Alcohol-Free

Analysis by Flavor:

Flavored

Unflavored

Analysis by Distribution Channel:

Supermarkets and Hypermarkets

On-Trades

Specialty Stores

Convenience Stores

Others

Country Analysis:

Germany

France

United Kingdom

Italy

Spain

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145