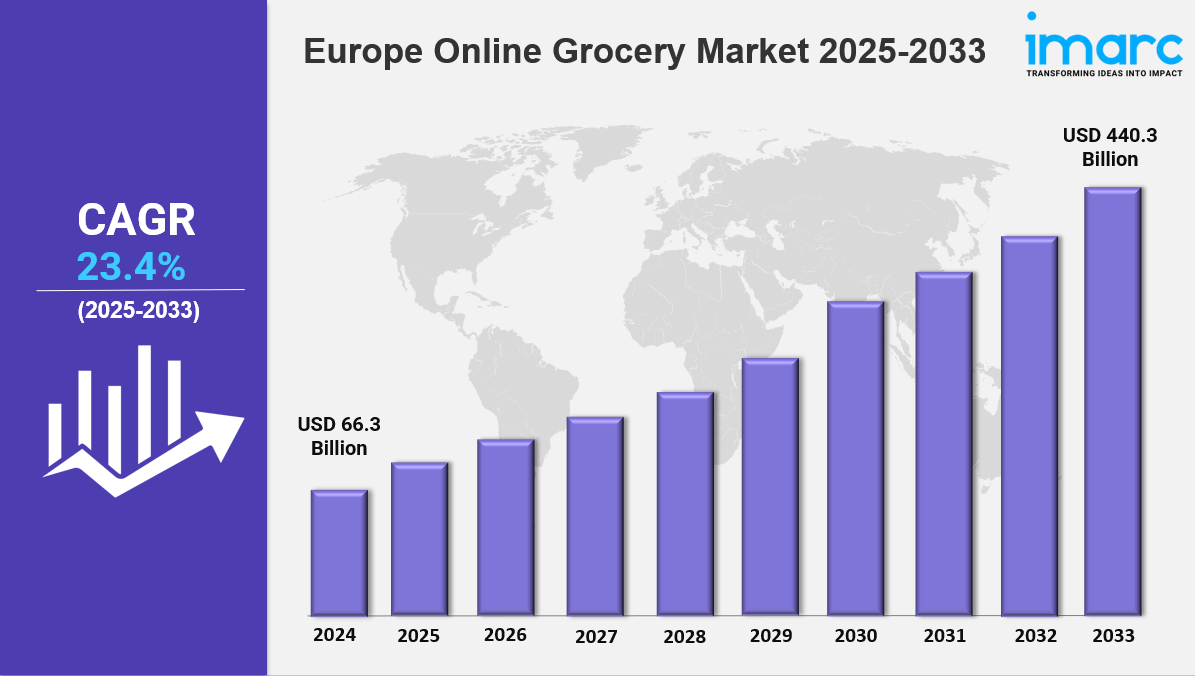

Market Overview 2025-2033

The Europe online grocery market size was valued at USD 66.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 440.3 Billion by 2033, exhibiting a CAGR of 23.4% from 2025-2033. The market is expanding rapidly due to growing e-commerce adoption, changing consumer preferences, and convenience-driven shopping habits. Technological advancements, quick delivery services, and digital payment solutions are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing digital adoption and demand for convenience

✔️ Rising preference for fresh, organic, and subscription-based grocery deliveries

✔️ Expanding investments in AI-driven logistics, dark stores, and quick commerce solutions

Request for a sample copy of the report: https://www.imarcgroup.com/europe-online-grocery-market/requestsample

Europe Online Grocery Market Trends and Drivers:

The Europe online grocery market is undergoing a major transformation, driven by rising consumer expectations and advancements in technology. Instant delivery is now a key trend, especially in urban areas where convenience is a top priority. Quick-commerce platforms like Getir, Gorillas, and Flink have rapidly expanded across major cities such as London, Berlin, and Paris, offering delivery within 15 to 30 minutes. According to the latest Europe online grocery market report, 2024 saw significant challenges, including increased operational costs and heightened scrutiny over labor practices. This led to consolidation among smaller players, but strong demand for real-time order tracking and delivery speed continues to push investments in micro-fulfillment centers and dark store networks.

Competition in the online grocery market in Europe has intensified as traditional supermarket chains like Tesco and Carrefour adopt hybrid models to rival fast-delivery startups. Environmental awareness is also shaping consumer behavior. Shoppers now prioritize eco-friendly packaging, carbon-neutral deliveries, and local sourcing. In response to the EU’s Packaging and Packaging Waste Directive introduced in 2024, major players like Ocado and Rohlik have shifted to reusable containers and plastic-free packaging to align with sustainability standards. Companies that fail to meet these expectations risk losing their Europe online grocery market share, as highlighted by a 2024 survey where 68% of consumers cited environmental credentials as a key factor in choosing an online grocery service.

Retailers are also collaborating with circular economy startups to improve supply chain efficiency and reduce food waste. The use of AI and machine learning has further evolved the market, offering hyper-personalized shopping experiences based on user preferences and past purchases. Brands like Amazon Fresh and HelloFresh have integrated generative AI tools to automate meal planning and predict demand. Subscription-based models have become increasingly popular, especially among busy professionals and health-conscious consumers, providing customized weekly grocery boxes.

While this shift reflects growing demand for personalized and convenient services, it also raises questions about data privacy and algorithmic fairness. The Europe online grocery market remains dynamic and fast-evolving, shaped by post-pandemic consumer habits and tech innovations. Demand for niche products—such as organic produce and ready-to-cook meals—continues to rise. However, new EU labor regulations have forced companies to re-evaluate their approach to gig workers and delivery pricing.

Technological innovation is also revolutionizing last-mile logistics. Autonomous delivery vehicles and drone trials in countries like Finland and Ireland offer cost-effective solutions. Although Northern Europe leads in adoption due to higher digital literacy, the online grocery market in Europe still faces regional disparities, with Southern and Eastern parts lagging due to infrastructure limitations. Cross-border collaborations, such as Germany’s Rewe working with Spanish startups, are emerging to bridge these gaps.

Looking forward, tools like augmented reality (AR) for virtual store navigation and blockchain for transparent supply chains will reshape the customer journey. As outlined in the Europe online grocery market report, future success will hinge on how well companies balance operational scalability with ethical and sustainable practices—key factors in navigating economic uncertainties and shifting consumer demands.

Europe Online Grocery Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Product Type:

Vegetables and Fruits

Dairy Products

Staples and Cooking Essentials

Snacks

Meat and Seafood

Others

Analysis by Business Model:

Pure Marketplace

Hybrid Marketplace

Others

Analysis by Platform:

Web-Based

App-Based

Analysis by Purchase Type:

One-Time

Subscription

Country Analysis:

Germany

France

United Kingdom

Italy

Spain

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145